The squaring of price and time was one of the most important and valuable discoveries that Gann ever made. In his trading course he stated “if you stick strictly to the rule, and always watch when price is squared by time, or when time and price come together, you will be able to forecast the important changes in trend with greater accuracy.”

The squaring of price with time means an equal number of points up or down, balancing an equal number of time periods- either days, weeks, or months. Gann suggested traders square the range, low prices, and high prices.

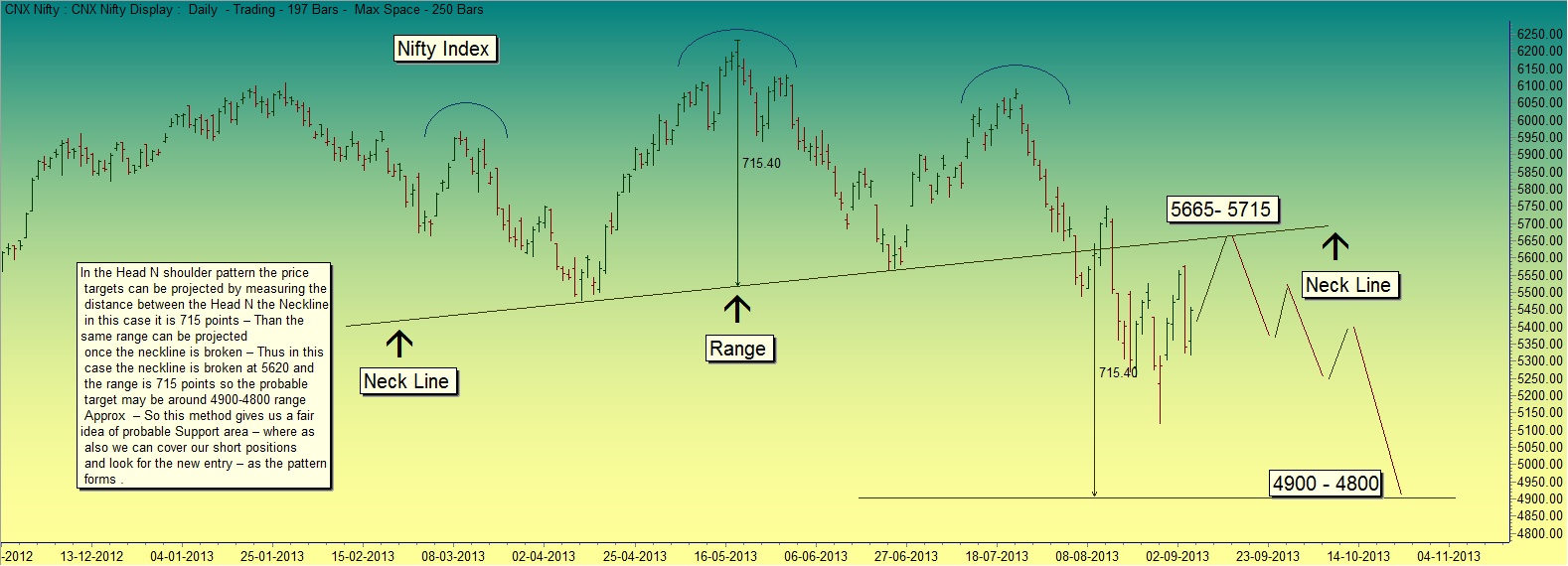

Squaring the Range

When Gann angles are drawn inside a range, the angles provide the trader with a graphical representation of the squaring of the range. For example, if a market has a range of 100 and the scale is 1 point, a Gann angle moving up from the bottom of the range at 1 point per time period will reach the top of the range in 100 time periods. A top, bottom, or change in trend is expected during the time period when this occurs. This cycle repeats as long as the market remains inside the range.

Squaring a Low

Squaring a low means an equal amount of time has passed since the low was formed. This occurs when a Gann angle moving up from a bottom reaches the time period equal to the low.

For example, if the low price is 100 and the scale is 1, then at the end of 100 time periods an uptrending Gann angle will reach the square of itself. Watch for a top, bottom, or change in trend at this point. The market will continue to square the low as long as the low holds.

A graphical representation of squaring a low price can be seen on a chart Gann called a zero-angle chart. This chart starts an uptrending angle from price 0 at the time the low occurred and brings it up at one unit per time period. When this angle reaches the original low price, a top, bottom, or change in trend is expected.

Squaring a High

Squaring a high means an equal amount of time has passed since the high was formed. This occurs when a Gann angle moving down from a top reaches the time period equal to the high. For example, if the high price is 500 and the scale is 5, then at the end of 100 time periods a downtrending Gann angle will reach the square of itself. Watch for a top, bottom, or change in trend at this point. The market will continue to square the high as long as the high holds.

A graphical representation of squaring a high price can be seen on a zero-angle chart. This chart starts an uptrending angle from price 0 at the time the high occurred and brings it up at one unit per time period. When this angle reaches the original high price, a top, bottom, or change in trend is expected.

Time analysis in Gann Theory requires the trader to study market swings, anniversary dates, cycles, and the squaring of price and time to help determine change in trend points.

Read Michael S. Jenkins masterpiece 'Square The Range Trading System'For Complete understanding of this Method